Welcome to Ultraground. We go to HFC meetings for you.

CC December 17, 2024 - MHFC December 13, 2024

District: 3 | Northwest McKinney

339-Unit HA Partnership | SEQ of Hwy 380 & Terry Lane | Approved

Citywide

McKinney Housing Finance Corporation (MHFC) RFQ | Developer Selected

District: 1 | North McKinney

442-Unit HA Partnership | SEQ Wilmeth Rd & Community Ave | Approved

You saved: 1h 8m

DISTRICT: 3

Jefferson Terry SEQ of Hwy 380 & Terry Lane

Northwest McKinney | 35.76 Acres | 339 Units | Ch. 392 | Approved

The Jefferson Terry development employs Chapter 392 of the Texas Local Government Code, establishing McKinney Housing Authority as direct owner with JPI as Special Limited Partner. Unlike PFC structures, this arrangement requires only Housing Authority board approval while maintaining property tax exemption benefits.

The $104.1 million project at Highway 380 and Terry Lane features a sophisticated economic participation framework: $775,000 in upfront development fees, 25% of $485,000 in construction materials tax savings, and a ground lease starting at $121,000 in 2027 with 3% annual escalators. Most notably, the Authority secures a $1.5 million disposition fee upon sale.

The path to this structure from July to December 2024 reveals McKinney's evolving approach. JPI initially proposed bypassing the RFQ process in July with a two-phase structure featuring $2.5 million in upfront fees and over $3.3 million in residual profit sharing.

After the Council denied the bypass, despite Mayor George Fuller’s support, Jefferson Terry was submitted to the RFQ. By October it had changed to a single-phase deal with $1 million in upfront payments and a $90,000 ground lease payment targeting a 70% public benefit ratio. The NRP Group was selected as the RFQ developer with a sizeable 30% of Developer fee for the MHFC and 50/50 cash flow split.

Jefferson Terry’s final December 17, 2024 Chapter 392 structure balances 45% at 80% AMI: 5% at 30% AMI, and 50% at Market Rate.

Developer & Construction Fees The MHA will receive substantial upfront fees at key project milestones:

Developer and General Contractor Fee: 75 basis points of the total $104.17MM project cost, equating to $775,000.

Professional Services Reimbursement: $220,000 total ($125,000 for legal fees and $95,000 for financial advisory services).

Construction Materials Tax Savings Share: 25% of the $485,000 in total savings ($242,500 at closing, $242,500 at construction completion).

Annual Operating Revenue Streams Starting in 2027, MHA establishes multiple recurring revenue sources:

Ground Lease Payment: 10% of estimated real estate taxes (approximately $121,000 in year one), escalating at 3% annually.

Annual Compliance Fee: $49,125 base fee with 3% annual increases.

Projected stabilized annual revenue by 2030: Approximately $184,000 combined from both streams.

Long-term Value Capture The structure includes significant back-end participation:

Disposition/Transfer Fee: $1.5MM upon sale or refinancing.

Total 10-year projected MHA benefit: $12.16MM

Right of First Refusal: MHA maintains purchase rights under Chapter 392

Term | Jefferson Terry |

|---|---|

MHA Developer Fee/GC Fee | $775,000 (75bps of total project cost) |

MHA Admin Fee | $49,125 per year + 3% escalator |

Construction Materials Tax Savings | 25% of $485,000 |

Lease Payment to MHA | 10% of est. real estate taxes |

Lease Escalator | 3% |

MHA Sale/Refinancing Fee | $1,500,000 Disposition/Transfer Fee |

The proforma indicates these revenue streams create a self-sustaining model for MHA, with projected income turning positive by 2030 after accounting for initial investment periods. What's particularly notable is how the fee structure aligns with the property's performance - as property values and rents increase, MHA's ground lease revenue grows proportionally.

This arrangement represents a more sophisticated approach than traditional housing authority partnerships, establishing multiple value capture points throughout the project lifecycle rather than relying primarily on upfront or backend fees. The structure appears designed to provide both immediate capital for MHA operations and long-term sustainable revenue to support future affordable housing initiatives.

City Council Work Session 7/23/24

Request to Bypass RFQ | Denied

JPI approached McKinney City Council with a proposal to bypass the RFQ process for a 792-unit HFC deal next to their Jefferson Verdant PFC project. The proposed partnership with the McKinney Housing Finance Corporation (HFC) offers 46% of units at 80% AMI and 5% at 60% AMI, with a 60-65% public benefit over 15 years.

Mayor George Fuller saw merit in the proposal. Fuller also spoke favorably of JPI's track record, noting the success of their previous project with the City. He likened it to economic development projects, emphasizing the potential to fund future affordable housing initiatives.

Mayor Pro Tem and District 3 Representative Geré Feltus acknowledged the proposal's potential to accomplish McKinney’s need for lower AMI units.

‟The struggle for me right now is that I don't have a whole lot of faith that we'll see developers come forward in the next year, two years, or five years that will address the need for the 30% and the 60% AMI. So I just want us to keep in mind that that's a problem that we're probably going to have to solve on our own. And this is one of the ways that we could potentially address that issue.

Council Member Justin Beller, however, opposed the bypass, emphasizing the need for lower AMI units and affordable ownership options. He emphasized the need for a comprehensive housing plan focusing on lower AMI units and affordable ownership products. Beller argued against bypassing the RFQ process while also questioning the financials.

‟We don't need that open process because we don't need this product. I mean, nothing shows us that we need more 80% AMI rental units. Our root policy says we have an abundance of them.

‟As soon as the developments are built, they're leased out. I know we leased Independence in just a couple of weeks. Honestly, there isn't anyone targeting the lower AMI. So 80% is pretty much what you're getting from everyone unless they're going to rehab current facilities.

You saved: 2h 1m

Developer: JPI, Miller Sylvan Phone: (214) 451-5908 Email: [email protected] LinkedIn

Public Partner: McKinney Housing Authority (MHA), Roslyn Miller Phone: (972) 542-5641 Email: [email protected], Margaret Li Phone: (972) 547-7323 Email: [email protected] LinkedIn

Staff Report: Jefferson Terry SR

Project Plans: Jefferson Terry Plan

Memorandum of Understanding (MOU): Jefferson Terry Approved Terms

MHFC RFQ

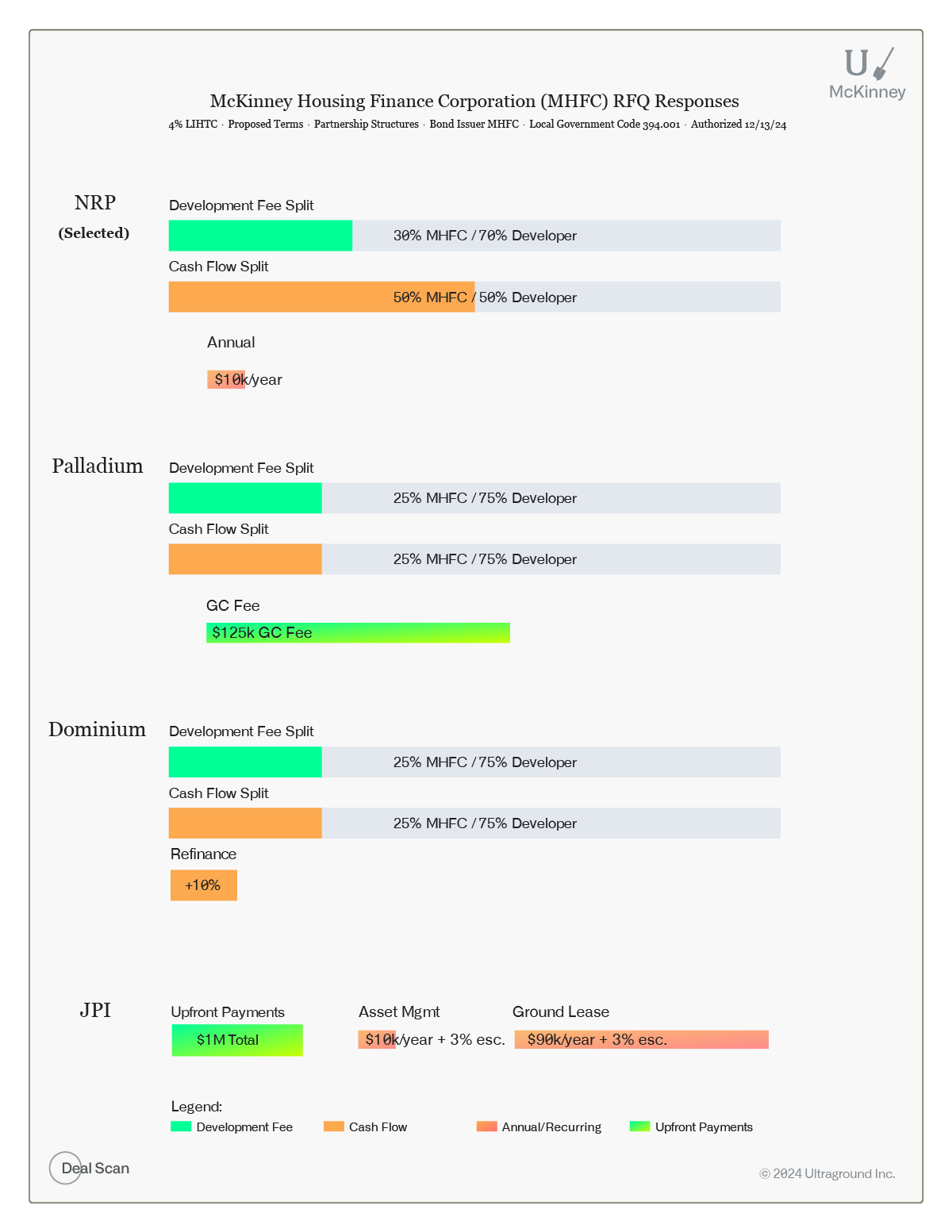

Developer Proposal Comparison | 394.001 Partnership Structures | Authorized 12/13/24

McKinney Housing Finance Corporation (MHFC) selected NRP as their development partner in December 2024, choosing them over Palladium, Dominium, and JPI in a competitive RFQ process. NRP's selection appears driven by their proven track record in McKinney and an unusually favorable 50/50 cash flow split structure - a significant departure from the typical 75/25 arrangements seen in housing authority partnerships. The RFQ sought proposals for affordable housing development utilizing 4% tax credits and bonds, with MHFC acting as the bond issuer and development partner. The winning proposal builds on NRP's existing McKinney project, which has already generated over $1 million in payments to MHFC through construction loan conversion.

This RFQ represents McKinney's evolving approach to affordable housing partnerships. Unlike their 2022 RFQ, which resulted in both PFC and MHFC structures, this solicitation specifically excluded PFC deals while opening the door to acquisition/rehabilitation of existing properties over 15 years old.

The standout element of NRP's proposal is their 50/50 cash flow split, which is notably more favorable to MHFC than market standards. They've structured their proposal building on their existing McKinney project (The Independence), which has already generated $1,011,860 in payments to MHFC through construction loan conversion. Their 70/30 development fee split represents a middle ground among submissions, more generous than some but not the highest offered. The inclusion of documented performance metrics from their existing McKinney project provides concrete evidence of execution capability - specifically demonstrating $222,000 at closing and $789,860 at conversion.

Palladium's approach centers on a standard 75/25 split structure for both development fee and cash flow. Their proposal includes a specific construction management fee of $600,000, paid pro-rata during construction. A distinguishing element is their inclusion of the general contractor role for MHFC, proposing a $125,000 fee (paid at $5,208 monthly) for providing the sales tax exemption on construction materials. This represents an innovative approach to maximizing MHFC's financial participation beyond traditional partnership structures.

Dominium's proposal stands out for its explicit inclusion of refinancing proceeds - offering MHFC 10% of residual/refinance proceeds in addition to the 25% cash flow share. They emphasize their in-house tax credit syndication capability through Polaris Capital, which could streamline the closing process and potentially reduce transaction costs. Their financing strategy explicitly excludes competitive funding sources (9% credits, HOME, CDBG), focusing exclusively on 4% credits and bonds, which suggests a more certain execution timeline.

JPI’s submission provides the most detailed pro forma of future cash flows, projecting specific numbers through year 15. The structure includes:

$90,000 annual ground lease payment (3% annual increase)

$10,000 annual asset management fee (3% annual increase)

$500,000 GC fee

$500,000 development fee

Their affordability mix targets 10% at 60% AMI and 40% at 80% AMI, with market-rate units capped at 140% AMI. The pro forma projects $18.9M in property tax savings over 15 years against $13.1M in public benefit, calculating a 70% public benefit percentage.

Particularly noteworthy for comparison is the treatment of upfront fees versus ongoing revenue streams. NRP and Palladium emphasize ongoing partnership revenue, while Jefferson Terry offers more substantial upfront payments. Dominium uniquely positions itself with the refinancing angle, suggesting a longer-term investment thesis.

The submissions reflect an evolution in MHFC deal structures since MHFC’s 2022 RFQ, with more sophisticated approaches to value sharing and risk allocation. The market appears to be settling around a 25-30% development fee share for the housing authority, but with increasing creativity in supplemental revenue streams and upfront payments.

A critical detail in the timing: construction period revenues (particularly the sales tax exemption benefit) are treated differently across proposals, with Palladium explicitly monetizing this through their GC fee structure, while others incorporate it into broader partnership economics.

McKinney HFC MOU Term Evolution

2019-2024

The Independence (2019) | NRP RFQ | Palladium RFQ | Dominium RFQ | JPI RFQ | |

|---|---|---|---|---|---|

Development Fee Split | 30% to MHFC | 30% to MHFC | 25% to MHFC | 25% to MHFC | Not Specified |

HFC Management/Admin Fee | $10,000/yr | $10,000/yr | Not Specified | Not Specified | $10,000/yr + 3% esc |

Contractor Fee | 25% of sales tax savings | Not Specified | $125,000 GC Fee (paid 1/24 per month during construction) | Not Specified | $500,000 GC Fee |

Lease Payment to HFC | Not Specified | Not Specified | Not Specified | Not Specified | $90,000/year + 3% esc |

Sale/Refi Fee/Split | 50/50 split of remaining net sale | Not Specified | 25% MHFC/75% Developer | 10% of refi | Not Specified |

Cash Flow Split | 50/50 | 50/50 | 25% MHFC/75% Developer | 25% MHFC/75% Developer | 70% public benefit |

DISTRICT: 1

Jefferson Wilmeth SEQ Wilmeth Rd & Community Ave

North McKinney | 15.74 Acres | 442 Units | Ch. 392 | Approved

The Jefferson Wilmeth deal is another evolution of McKinney Housing Authority's affordable housing strategy, emerging from a site with a complex entitlement history. Originally planned in 2021 as a conventional multifamily development on 18.7 acres, the project evolved into a 442-unit Chapter 392 partnership on 15.7 acres.

Jefferson Wilmeth employs a three-tier affordability structure: 50% market rate, 45% at 80% AMI, and 5% at 30% AMI. The project's total development cost is $115,718,000 ($261,214 per unit), financed through a $63,600,000 senior construction note at SOFR plus 3.0% (3.5% floor), $23,100,000 in preferred equity at 13.75%, and $28,900,000 in common equity.

The MHA economic participation expands upon previous terms seen in the market. The authority receives a 75-basis-point developer and contractor fee totaling $866,433 - notably higher than Jefferson Terry's $775,000. The annual administrative fee starts at $55,375 with 3% escalators, complemented by a ground lease payment of 15% of estimated real estate taxes (compared to Jefferson Terry's 10%). Construction materials tax savings participation remains consistent at 25% of the total benefit.

Most significantly, the refinancing fee increases to $2.56 million from Jefferson Terry's $1.5 million, demonstrating MHA's growing leverage in negotiations. The project's 172% benefit-to-tax ratio substantially exceeds both market standards and Jefferson Terry's 70% target.

Term | Jefferson Terry | Jefferson Wilmeth |

|---|---|---|

MHA Developer Fee/GC Fee | $775,000 (75bps of total project cost) | $866,433 (75bps of total project cost) |

MHA Management/Admin Fee | $49,125 per year + 3% escalator | $55,375 per year + 3% escalator |

Construction Materials Tax Savings | 25% of $485,000 | 25% of $553,000 |

Lease Payment to MHA | 10% of est. real estate taxes | 15% of est. real estate taxes |

Lease Escalator | 3% | 3% |

MHA Sale/Refinancing Fee | $1,500,000 Disposition/Transfer | $2,561,160 Refinance Fee in Year 4 |

City Council 11/19/24

PD/C → PD for MF | Approved

The project has shifted significantly since its 2021 origins. JPI increased density from 25 to 29 units per acre while shrinking the site from 18.7 to 15.7 acres. McKinney City Council approved the final 460-unit deal on November 19, 2024. The project gained momentum by addressing Council Member Cloutier's parking concerns, which were resolved by the site's location on no-parking arterials.

‟So that problem is mitigated. I will trust that the developer knows what he's doing here with respect to their parking, or they're going to suffer and demand for their units.

Developer: JPI, Miller Sylvan Phone: (214) 451-5908 Email: [email protected] LinkedIn

Public Partner: McKinney Housing Authority (MHA), Roslyn Miller Phone: (972) 542-5641 Email: [email protected]

Staff Report: Jefferson Wilmeth SR

Project Plans: Jefferson Wilmeth Plan

Memorandum of Understanding (MOU): Jefferson Wilmeth Approved Terms

Thank you for being a part of Ultraground.